The launch price per share is US $500.

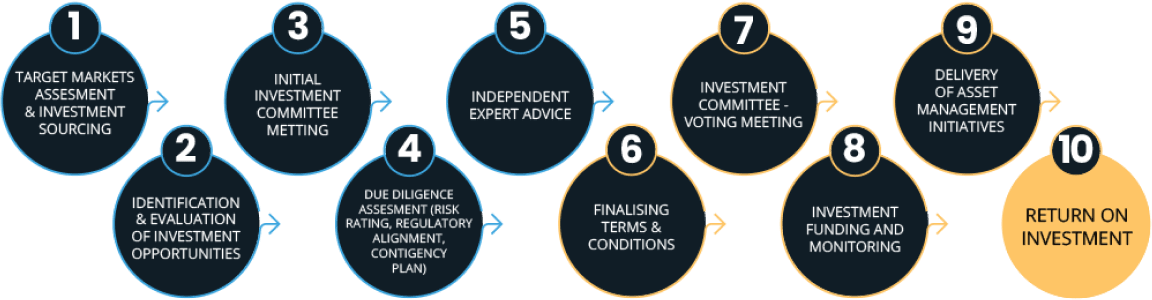

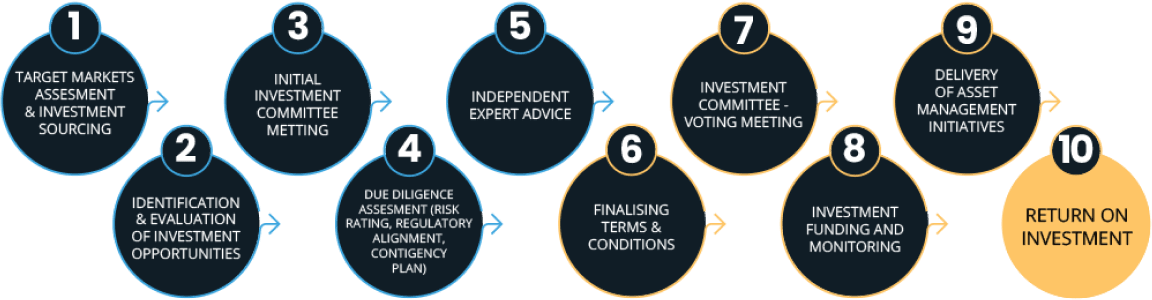

With our highly experienced executives and professional advisors we are adopting a Barbell approach to investment opportunities across different asset classes such as those detailed in the thematic approach. Blending opportunity on added value development on prime opportunities locking in annual reviews compounding rents measured to CPI (capped and collared) on long dated income streams alongside high growth and added value opportunity in other asset classes.

A diversified approach mitigating risk in these different asset classes in opportunistic territories in the opinion of the Fund will benefit long term growth and drive yield alongside the reinvest income and realisation strategy. The targeted Barbell approach is initially between 6-7% (before compounding) but may vary according to opportunities recommended by the Investment Committee. The Fund benefits from an immediate significant pipeline of opportunity carefully selected and secured (subject to conditions) on asset classes identified in the strategy.

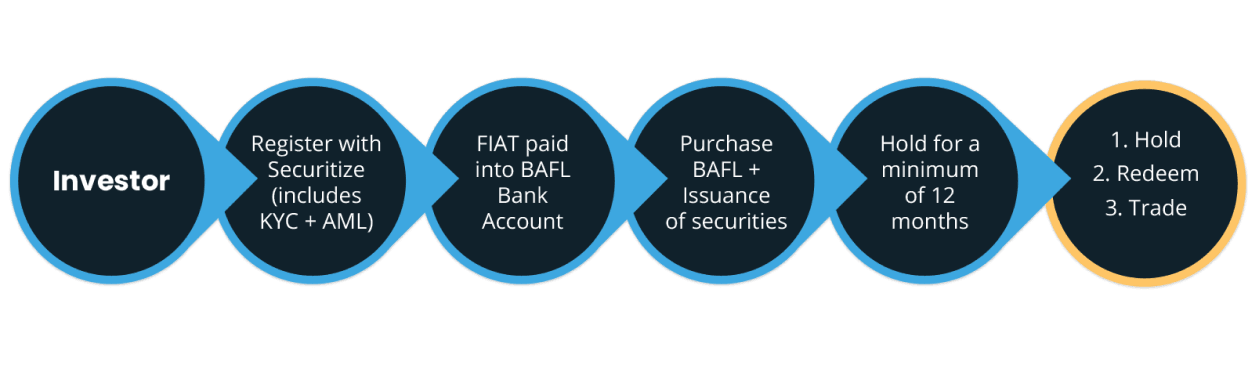

Investing with BAFL

Demographic shifts, globalisation and digitalisation are having a profound impact on the way real assets is being used. Our investment research has shown that these trends can be grouped into overarching “themes”.

Retail food in strategic transport interchange locations

Distribution and business units

Global Real Estate in tier one locations

Renewable Energy & Infrastructure

Related digital infrastucture

Capable of rapid turnaround or growth

Our key coinsiderations

Making sure the jurisdiction we consider is monitored by a competent regulator (using the FCA’s standard of governance as a benchmark)

Assessing the stability of the returns within the core sectors with experts

Evaluating the jurisdiction’s record of human rights protections (i.e. is the country on the fund’s red list of territories where it will not operate?)

Adopt a sustainable investment strategy that includes reviewing the investments, opportunities compatible with environment, social and governance

(ESG) initiatives

Customize in Real Assets investment solutions across strategies with different levels of risk adjusted return profiles

Buy now

The launch price per share is US $500. Existing shareholders may make additional investments in amounts of at least US $500 at each subscription date, or in lesser amounts or at other times as determined by the directors. All subscriptions must be paid in USD, Ether or Bitcoin, unless the directors consent to an in-kind contribution of securities or other property.

We are partnering with fully digital, regulatory compliant platforms for issuing and trading digital asset securities - to create, issue, transfer and register BAFL tokens on the blockchain. Other platforms will be added as the infrastructure evolves. We have also appointed Coinbase and its affiliate, Coinbase Custody Trust Company, as the custodian of its BAFL tokens.